Show content of Magnus, Victor von

| Biographical data: | 13.09.1828 in Berlin - 29.06.1872 in Potsdam |

| Institution: | Deutsche Bank |

| Functions: | Chairman of the Supervisory Board 1870-1871 |

Victor von Magnus was not only part of the founding circle of Deutsche Bank, but also the first Chairman of the Supervisory Board of the institution newly founded in 1870. For the F. Mart. Magnus banking house, he subscribed to Deutsche Bank shares worth 175,000 Thalers and was elected by the founders as the first Chairman of the Supervisory Board. By mid-1871, he had to resign from the position due to health reasons. When he died childless the following year, the F. Mart. Magnus banking house was dissolved.

Magnus came from a Jewish merchant and scholar family. His grandfather, Immanuel Meyer Magnus, who was married to the daughter of the prominent Berlin merchant and banker Benjamin Josef Fränkel, had himself baptized in 1807 and founded his own banking business the following year. His son Martin Friedrich took over the banking house, which had operated under the name "F. Mart. Magnus" since 1821. Alongside the Mendelssohn banking house, it rose to become the most respected private bank in Berlin in the following decades, which was also manifested by the bank's admission to the so-called Prussian Consortium in 1859. Its owner, Martin Friedrich Magnus, had already been ennobled in March 1853. His son Victor long stood in his father's shadow. Only after his father's death in 1869 could he work independently. In the same year, Adelbert Delbrück had approached him to win him over for the founding of a bank dedicated to financing German foreign trade. The Mendelssohn banking house had shown no interest. However, Delbrück considered it absolutely necessary to involve a leading Berlin firm in the founding.

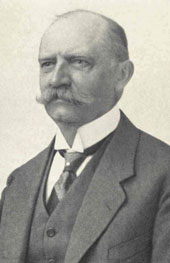

Show content of Mankiewitz, Paul

| Biographical data: | 07.11.1857 in Mühlhausen - 22.06.1924 in Selchow/Mark |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1898-1923, (Spokesman 1919-1923) |

After completing his Abitur in Halberstadt, Mankiewitz underwent banking training at the Hanau company in Mülheim/Ruhr and subsequently worked for Vereinsbank in Mühlhausen and Anglo-Deutsche Bank in Hamburg. In 1879, he joined the Deutsche Bank headquarters in Berlin. He was granted power of attorney in 1885 and became deputy director in 1891.

In 1898, he was appointed to the Management Board and served as its spokesperson from 1919 to 1923. Mankiewitz was considered an all-rounder in the banking business, but his specialty was stock exchange and foreign exchange trading. As stock exchange director, he very successfully represented the bank on the Berlin Stock Exchange, with Mankiewitz claiming that he had "a feeling in his fingertips for the trend" in this area. His unerring skill was particularly evident in transactions involving Russian currency and Russian bonds.

Another domain of his activity was the insurance sector, where he represented the bank on the supervisory boards of several companies. In 1901, he proved himself a skilled negotiator during the Northern Pacific Crisis, from which Deutsche Bank, engaged in the North American railway business, emerged strengthened. Mankiewitz worked on solving numerous economic policy problems. As a particular expert in monetary policy, he represented Deutsche Bank on the advisory board of the Reichsbank from 1914, where he contributed, among other things, to the financial and technical management of Allied reparation demands. He facilitated the deployment of considerable financial resources to alleviate social hardship for foreigners and German prisoners of war who had become destitute due to the World War. Numerous students at universities and technical colleges also benefited from the Deutsche Studentenhilfe (German Student Aid) initiated by Mankiewitz.

Mankiewitz's tenure as spokesperson fell during a politically turbulent period, in which the bank's business entered a prolonged "defensive" phase as a result of the First World War. Due to health problems, he resigned from the Management Board at the end of 1923. Characteristic of Mankiewitz's attitude is the principle he frequently cited: "Deutsche Bank's main asset is the trust placed in it, and our foremost task must be to maintain it."

Show content of Marcuse, Hermann

| Biographical data: | 04.10.1824 in Hannover - 08.04.1900 in Wiesbaden |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1900 |

Among the members of Deutsche Bank's first Supervisory Board, Hermann Marcuse was one of the proven experts in US business. In 1870, upon the founding of Deutsche Bank, he subscribed for shares as a private individual for 314,000 Thaler and became a member of the Supervisory Board, to which he belonged until his death.

Hermann Marcuse had come to the USA in his youth and gained valuable experience there at the New York private bank G. von Baur & Co., founded in 1854. This banking house was a limited partnership of the Darmstädter Bank für Handel und Industrie. In 1860, Marcuse founded the private bank Marcuse & Baltzer in New York together with Herman R. Baltzer, which operated very successfully in the United States and continued to represent the interests of the Darmstädter Bank there. The firm was one of the leading New York private banks and, among other things, arranged the financing of the Union states in the American Civil War, in which capital from Germany was also involved. When Marcuse retired six years later to settle in his homeland, Baltzer found a new partner in William Taaks. The Darmstädter Bank remained involved in the private bank Baltzer & Taaks until its liquidation in 1885.

At the time of Deutsche Bank's founding, he lived as a retired gentleman in Walluf in the Rheingau. He served the bank primarily as an advisor on its American affairs. His nephew Paul Lichtenstein, who had learned the banking business at Baltzer & Taaks, became a co-owner in 1872 of the newly founded private bank Knoblauch & Lichtenstein, which, as a limited partnership, represented the interests of Deutsche Bank in the United States. Marcuse had already been active as a company founder during his time in the USA. He was a member of the German Society in New York and a director of the German Life Insurance Company. In addition to investments in American railway construction, after his return to Europe, he participated, for example, in the Amsterdamer Bank, the Schweizerischer Bankverein, and the Süddeutsche Immobilien-Gesellschaft.

Show content of Matherat, Sylvie

| Biographical data: | 1962 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board from 2015-2019 |

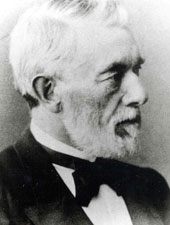

Show content of Meier, Hermann Henrich

| Biographical data: | 16.10.1809 in Bremen - 17.11.1898 in Bremen |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1871 |

As a founding shareholder of Deutsche Bank, the Bremen merchant and politician Hermann Henrich Meier acquired shares worth over 50,000 Thaler in 1870 and is one of the Bremen subscribers who are not on the initial subscriber list, although he was involved in the founding process. Perhaps his significant position in foreign trade contributed to his election to the Supervisory Board at the first general meeting, from which he resigned just one year later.

Meier is considered the founder of the shipping company Norddeutscher Lloyd, which became one of the most important companies for international commercial transport. The Bremen shipping company, whose chairman Meier was on the Supervisory Board, also achieved an outstanding position in passenger transport, especially for shipping routes to the USA. His father, also named H.H. Meier, had founded the trading company H.H. Meier & Co. in Bremen, of which Meier became a partner in 1834 and which was primarily active in transatlantic trade.

Banking was not new territory for Meier at the time of Deutsche Bank's founding; the Bremer Bank was established with his participation in 1856, and he chaired its Supervisory Board for a long time. Under his leadership, Bremer Bank merged with Dresdner Bank in 1895. In 1875, he was involved in the background in the so-called Bremen Shareholder Dispute, in which a group of Bremen shareholders of Deutsche Bank demanded a capital reduction.

Politically, Meier, like the majority of Deutsche Bank's founders, sided with the Liberals. He advocated for free trade, for example, from 1864 in his capacity as President of the German Trade Congress. From 1852, he became a member of the Bremen Chamber of Commerce, rising to its president eleven years later. In 1867, he was elected as a delegate to the North German Confederation, and he was a member of the German Reichstag from 1878 to 1890 as part of the National Liberal faction.

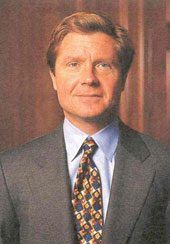

Show content of Merkle, Hans Lutz

| Biographical data: | 01.01.1913 in Pforzheim - 22.09.2000 in Stuttgart |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board, Member of the Supervisory Board 1960-1988; Co-Chairman of the Supervisory Board 1968-1978; Chairman of the Supervisory Board 1984-1985 |

Hans Lutz Merkle was born in Pforzheim as the son of a printing press owner and publisher. After a commercial apprenticeship in his father's business, he worked for the Reutlingen textile company Ulrich Gminder from 1935 onwards and became a member of its Executive Board in 1949. In 1958, he moved to the management of Robert Bosch GmbH, serving as its Chairman from 1963 to 1984. This was followed by another four years at the head of the Supervisory Board, of which he remained honorary chairman until his death. Under his leadership, Bosch became a globally renowned high-tech group. Hans L. Merkle maintained good personal relationships with the leadership of Deutsche Bank (especially with Hermann J. Abs and Wilfried Guth). He was also a member of the Bank's Supervisory Board for many years, where he held a prominent position: from 1960 to 1988, Merkle was a member of the Supervisory Board, from 1968 to 1978 its deputy chairman, and from July 3, 1984, to May 14, 1985, even its chairman. This broke with a long-standing tradition at Deutsche Bank, which stipulated that the Chairman of the Supervisory Board was recruited from the ranks of former Spokesmen of the Management Board. Merkle's predecessor, Franz H. Ulrich, could no longer perform the duties of the office due to health reasons. Thus, this interim solution was chosen, which at the same time expressed the great trust placed in him. With his successor Wilfried Guth, the previous mode was already resumed. Even after retiring from these official functions, he maintained good contacts with leading figures of the Bank. In particular, their most important industrial commitment, Daimler-Benz AG, which was also one of Bosch's most important customers, was close to his heart. In addition, he held further mandates at leading corporations, from BASF and Volkswagen to Allianz. Merkle was one of the most influential personalities in the German economy. He advised Chancellor Kiesinger and was also part of Helmut Schmidt's circle of advisors. He was considered a proponent of "moral capitalism," based on personal achievement, a sense of duty, and responsibility towards the community. In recognition of his achievements, the Robert Bosch Anniversary Foundation, established to promote science and young scientists, was renamed the Hans L. Merkle Foundation in 1997.

Show content of Mertin, Klaus

| Biographical data: | 09.03.1922 in Neisse - 31.05.1995 |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1971-1988 |

The Silesian native began his banking career in 1951 at Norddeutsche Bank in Hamburg, one of the then successor institutions of Deutsche Bank. As a member of the 1922 cohort, military service and prisoner-of-war status initially blocked his professional career after graduating from high school and only allowed him to begin studying business administration at the University of Hamburg in 1948. Parallel to his work at the bank, he worked on his dissertation on the problems of collective value adjustments, with which he was awarded a Dr. rer. pol. in 1957. In the same year, Klaus Mertin moved to the bank's headquarters in Frankfurt, where the core tasks of today's controlling department were carried out in what was then the chief accountant's office. In 1969, he took over responsibility for the bank's entire accounting system. In 1971, he was appointed to the Management Board (until 1974 as a deputy member of the Management Board), to which he belonged until 1988. For two decades, he ensured the further development of the accounting system to increase its informative value and develop it into a business policy instrument. For many years, Mertin was also responsible, within his regional remit, for the bank's business in Berlin and the Stuttgart branch district. His contributions to connecting banking science and practice were also recognized by academia. In 1990, Mertin received an honorary doctorate from the Department of Economics at the University of Frankfurt.

Show content of Merton, Richard

| Biographical data: | 01.12.1881 in Frankfurt on the Main - 06.01.1960 in Frankfurt am Main |  |

| Institution: | Süddeutsche Bank AG, München | |

| Functions: | Chairman of the Supervisory Board 1955 - 1957 |

Richard Merton came from an old Jewish family, whose lineage can be traced back to the 18th century under the name Moses. After graduating from the Lessing-Gymnasium in Frankfurt (1900), he received practical business training in his father's family firm, supported by several years of work abroad, and also completed studies in law and cameralistics. For several decades, Merton shaped the development of Metallgesellschaft AG. From 1907 to 1911, Merton was a member of the Supervisory Board of this industrial company, from 1911 to 1928 a member of the Management Board, and from 1928 to 1939 Chairman of the Supervisory Board. During this time, Merton held other important positions: for example, from 1928 to 1932 he was a city councilor for the city of Frankfurt am Main, a member of the Reichstag as a DVP deputy from 1932 to 1933, and from 1932 to 1938 both a member of the Presidium and the Administrative Board of the International Chamber of Commerce. In 1938, due to his Jewish heritage, he was forced to resign from all his positions and had to go into exile in England in 1939. Even after the war, Merton maintained his versatility and was a leading figure in a total of 35 associations. Just one year after his return in 1947, he again became Chairman of the Supervisory Board of Metallgesellschaft AG. From 1958, he served as its Honorary Chairman. Richard Merton had already been a member of the Frankfurt-Hessian Advisory Board of Deutsche Bank from 1934 to 1937. After the war, from 1952 to 1955, he was Deputy Chairman of the Supervisory Board of Süddeutsche Bank AG, Munich. From March 24, 1955, to 1957, he finally served as Chairman of the Supervisory Board of this successor institution to Deutsche Bank.

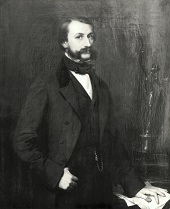

Show content of Meyer, Abraham

| Biographical data: | 1810 - 14.02.1881 in Berlin |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1881 |

In Deutsche Bank's annual report for 1876, Meyer had already changed his first name to Adolf, whereas in the list of initial subscribers at the founding of Deutsche Bank in 1870, he still bore the name Abraham. He acquired shares worth 470,000 Thalers for his banking house E.J. Meyer, which corresponded to the second-largest subscription amount. He was a member of Deutsche Bank's Supervisory Board from his election at the first General Meeting until his death in 1881. On behalf of the Supervisory Board, he was initially responsible for auditing the balance sheets in the annual report.

The Jewish banking house E.J. Meyer was founded in 1816 by Abraham Meyer's father, the merchant Elias Joachim Meyer. He himself became a partner in 1847 and managed the house together with his brother Friedrich. Together, they participated in the financing and founding of various railway companies, banks, and industrial enterprises, for example, the Mitteldeutsche Creditbank, and in 1872, together with Deutsche Bank, the Internationale Bau- und Eisenbahngesellschaft AG, which entered into a close association with the Frankfurt construction company Philipp Holzmann a year later. Indicative of the standing of the banking house E.J. Meyer was Abraham Meyer's appointment to the General Council of the Reichsbank in 1875.

Show content of Michalowsky, Carl

| Biographical data: | 01.09.1862 in Löbau/West Prussia - 26.05.1941 in Berlin |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1908-1927 |

Carl Michalowsky came from a family of pharmacists. After completing his legal education, Michalowsky served as a district judge in his birthplace, Löbau, from 1889. In 1891, he became a legal advisor to the provincial administration of West Prussia; in 1895, he moved to Stettin as city treasurer.

At the beginning of 1900, he joined Deutsche Bank, initially as a legal counsel for the secretariat. Rising rapidly, he was appointed Deputy Member of the Management Board in 1905 and full Member of the Management Board in 1908. His department included internal administration and organization, the secretariat, the legal department – he was temporarily the sole lawyer on the Management Board – and later the supervision of the branch districts of Frankfurt am Main, Pomerania, Silesia, East and West Prussia. Oversight of Deutsche Bank's archives also fell under his responsibility. From 1914 onwards, he was responsible for all personnel matters, a task that was associated with exceptionally great difficulties during the war and inflation years. The steady increase in the number of employees from 11,300 in 1914 to 40,000 at the end of 1923 was followed by a reduction to 14,800 in 1927. Michalowsky endeavored to carry out this reduction in staff by more than 25,000 people in the most socially acceptable manner possible. After his departure from the Management Board, he remained a member of the Supervisory Board until 1933.

The welfare institutions of Deutsche Bank, which were established during his time as head of personnel, were significantly promoted in many ways through his personal initiative, such as the recreation homes Johannaberg, Sellin, and Caputh.

Show content of Millington-Herrmann, Paul

| Biographical data: | 10.11.1858 in Hamburg - 24.05.1935 in Berlin |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1911-1928 |

Millington-Herrmann came from an old-established Hamburg merchant family, which, among other things, owned the banking house "De Chapeaurouge & Co. Succ.", established in 1792 and managed by his father since 1859. After an apprenticeship at the Hamburg banking house Haller, Söhle & Co., he went abroad for two years from 1881 (Spain, France, England). Upon his return to Hamburg, he joined his father's banking house, initially as an authorized signatory, later as a partner. Due to various confusions with a Braunschweig firm Paul Julius Herrmann, he added his English wife Lydia Eliza Millington's maiden name to his own in 1891.

In 1895, Deutsche Bank board member Roland-Lücke convinced Millington-Herrmann to establish the business of Deutsche Ueberseeische-Bank in Chile. There, he soon gained the trust not only of local clients but also of the Chilean government, which he advised during economic crises.

Soon after his return to Germany in 1899, he joined Deutsche Bank. When Leipziger Bank collapsed on June 25, 1901, Millington-Herrmann swiftly organized the opening of a Deutsche Bank branch in Leipzig just one day later, thereby positioning the company in the Saxon banking center. At the end of the same year, at his suggestion, a branch was established in Dresden through the acquisition of the Dresden banking business Menz, Blochmann & Co., where Deutsche Bank had maintained a deposit office since 1889. His work in Saxony was recognized in 1911 by his appointment to the Management Board. His responsibilities particularly included overseas and reimbursement business. In addition, he was responsible for overseeing the foreign (London, Brussels, Constantinople), North and Central German branches.

During the First World War, he placed his overseas experience at the service of the war economy in leading and advisory capacities. At his initiative, Deutsche Bank participated in the founding and development of Deutsche Ozean-Reederei in Bremen, which first deployed the submarine "Deutschland" in 1916 for postal and commercial traffic between the USA and Germany. After 1918, he endeavored to resume the bank's foreign relations, which had been interrupted by the war, and to adapt its overseas business to the changed circumstances.

Millington-Herrmann was represented on the supervisory boards of more than 60 companies, primarily including those in the shipping, textile, machinery, mining, cigar, and chemical industries. He remained a member of Deutsche Bank's Supervisory Board until 1934 after stepping down from the Management Board.

Show content of Miquel, Johannes von

| Biographical data: | 19.02.1828 in Neuenhaus - 08.09.1901 in Frankfurt am Main |  |

| Institution: | Disconto-Gesellschaft | |

| Functions: | Joint Proprietor 1869-1873 |

Miquel, who had been active as a lawyer since 1854 and was a member (National Liberal) of the Prussian House of Representatives, became Lord Mayor of Osnabrück in 1865. With his appointment as a partner, the Disconto-Gesellschaft secured the services of an experienced lawyer, administrative official, and politician. His importance for the bank lay less in his advisory role as legal counsel, but rather in the support he could provide as a political representative in the Prussian House of Representatives, and from 1871 also in the German Reichstag, for the Disconto-Gesellschaft's participation and investment plans in the parliaments. This was particularly true for the construction of German railway lines and the Gotthard Railway, as well as for the establishment of the Prussian Central Land Credit Company (Preußische-Central-Bodencredit-Aktiengesellschaft). However, the combination of financial and parliamentary activities inevitably led to a problematic entanglement of both areas for Miquel, so he withdrew from active banking business in 1873 and only took over the chairmanship of the administrative board, which he resigned in 1876. In the same year, he once again became Lord Mayor of Osnabrück. From 1880 to 1890, he served as Lord Mayor of Frankfurt am Main and was then appointed Prussian Minister of Finance in Berlin, where he gained widespread recognition for the successful implementation of the Prussian tax reform ("Miquel's tax reform"). Similar to Karl Helfferich, Johannes von Miquel's activities for a private credit institution have largely been forgotten.

Show content of Mitchell, Edson

| Biographical data: | 19.05.1953 in Portland/Maine - 22.12.2000 in Rangeley/Maine |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 2000 |

Edson Mitchell grew up in modest circumstances as a descendant of Swedish immigrants. He completed a degree in economics at Colby College and the Tuck School of Business at Dartmouth College, graduating in 1978 with a Master of Business Administration. Afterwards, he gained experience at Bank of America in Chicago before joining Merrill Lynch in New York in 1980. Although he achieved great success there, he did not rise to the very top leadership ranks. In 1995, Deutsche Bank recruited him to take over the leadership of its Global Markets division. From London, he played a significant role in enabling the bank to establish itself among the top-tier global investment banks. Under his responsibility, trading activities for foreign exchange, bonds, and equities saw particular success. In June 2000, Mitchell, along with Michael Philipp, became the first American to be appointed to the Group Executive Committee. On a personal level, Mitchell was involved as a co-founder of the Rangeley Lakes Heritage Trust in his home state of Maine. Mitchell died in a private plane crash at the end of 2000. The self-made man "Ed" Mitchell was considered by admirers and critics alike to be the epitome of the success-oriented Anglo-American investment banker.

Show content of Mölle, Andreas Friedrich

| Biographical data: | 1813 - 1878 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1871-1872, Member of the Supervisory Board of the Disconto-Gesellschaft 1877-1878 |

Among the members of the Management Board whose lives are least known is Andreas Friedrich Mölle. He came from Wanzleben near Magdeburg, where he was born in 1813 as the son of a shepherd. Before he was a member of the Deutsche Bank Management Board from January 1871 to January 1872, he had completed a career as a civil servant. From 1843 to 1875, he can be traced in the address directory for Berlin and Potsdam. First as Secretary and Calculator in the Treasury and Budget Department of the Prussian Ministry of Finance, then in the same department as "Geheimer Rechnungsrat" (Privy Councillor of Accounts) and finally as "Geheimer Oberfinanzrat" (Privy Senior Financial Councillor). Between 1866 and 1871, he must have left civil service; the 1872 address directory mentions him as "Geheimer Oberfinanzrat a.D." (Privy Senior Financial Councillor, retired).

Little is known about his activities at Deutsche Bank, which he took over following Wilhelm A. Platenius, a Management Board member who had resigned after only a few months. The first annual report for 1870 bears Mölle's signature, as do the bank's first shares, which were issued to shareholders in September 1871 after the capital was fully subscribed. Otherwise, it is reported that his work style, trained in ministerial bureaucracy, did not suit the newly founded Deutsche Bank. Ludwig Bamberger wrote in his memoirs: "When it came to appointing a chief director, the Berlin participants, particularly at the instigation of Adalbert Delbrück, who was the leading spirit in this, decided, out of Prussian respect for bureaucracy, to place a 'Geheimer Finanzrat' (Privy Financial Councillor) who had long worked in state administration in this position. The man was neither stupid nor ignorant, but I have never seen anyone more unsuitable for such a role. The civil service profession and commercial occupation are as far apart as heaven and earth." This cannot have escaped Mölle either; in any case, as his Management Board colleague Hermann Wallich later reported, "after one year of activity, he came to the realization that the qualification of a high-ranking civil servant was not sufficient to take over the management of a commercial institution."

Regarding his later activities, it is only known that in 1877 he joined the Supervisory Board of the Disconto-Gesellschaft, to which he belonged until his death in 1878.

Show content of Moltke, James von

| Biographical data: | Unknown |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board since 1 July 2017 |

Show content of Moreau, Nicolas

| Biographical data: | 1965 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2016-2018 |

Show content of Mosle, Alexander Georg

| Biographical data: | 08.09.1827 in Bremen - 21.08.1882 in Rio de Janeiro |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1882 |

Alexander Mosle, Consul of Bremen, participated in the founding of Deutsche Bank with shares worth 16,000 Thalers and was elected to its Supervisory Board at the first Annual General Meeting. He took on another role as chairman of the local committee of the Bremen branch, which opened in 1871. In addition to this involvement, he invested in other trading companies and fisheries.

Mosle had excellent trade relations in Latin America, particularly in Brazil. His father was a partner in the trading company Stockmeyer & Co., into whose family Alexander later married. Christian Stockmeyer had been Consul of the City of Bremen in Brazil before Mosle and established his trading house there. Alexander Mosle operated from Brazil and Bremen for the trading and shipping company, of which he later became a partner, thus receiving the name Stockmeyer, Mosle & Co. From 1870, Mosle acted as the sole owner of the firm Mosle & Co., whose interests he also represented on Deutsche Bank's Supervisory Board until his death.

Mosle was first elected to the Bremen Chamber of Commerce and later to the German Chamber of Commerce and was Vice-President of the German Trade Congress. He reached the peak of his political career by being elected to the Reichstag (1871-1881), where he represented the National Liberals. However, when Mosle sided with Bismarck's position against free trade and in favour of protective tariffs, he not only caused annoyance among his voters, but also became a political opponent of Hermann Henrich Meier, who, like him, was among the founders of Deutsche Bank and had served on its Supervisory Board.

Show content of Mosler, Eduard

| Lebensdaten: | 25.07.1873 in Straßburg - 22.08.1939 in Berlin |  |

| Bank: | Disconto-Gesellschaft / Deutsche Bank | |

| Funktion: | Geschäftsinhaber / Vorstand: 1911-1939 (Sprecher 1934-1939) |

For almost three decades of his professional career, Eduard Mosler was associated with Disconto-Gesellschaft and Deutsche Bank.

The doctor of law initially began his professional career in public service, where he worked as a court assessor, before joining Berliner Handels-Gesellschaft as a legal counsel in 1900. Just two years later, at the age of twenty-nine, he was admitted to the circle of business owners. Mosler worked alongside the famous Carl Fürstenberg and was already being discussed in the press as his successor. Many a deal that outwardly appeared to be Fürstenberg's achievement originated from Mosler's considerations.

However, Mosler did not remain with Berliner Handels-Gesellschaft, but joined the management of Disconto-Gesellschaft in Berlin in 1911. Here, he primarily worked in the stock exchange business. Another main area of his activity was rationalization in the banking sector, which he himself successfully realized in 1929 through the merger of Disconto-Gesellschaft with Deutsche Bank. Together with Oscar Schlitter of Deutsche Bank, he had negotiated the terms for the merger of the two banks. The fact that after the merger, the men of Disconto-Gesellschaft had the majority on the Management Board of the united bank demonstrated Mosler's skillful negotiation tactics. He himself was a member of the Management Board until 1939 and, after the forced resignation of Oscar Wassermann and Georg Solmssen by the National Socialists, assumed the role of spokesperson for Deutsche Bank in 1934.

He skillfully managed to fend off the initial criticism of the National Socialists against the major banks, but had to accept increasing restrictions on the business freedom of his institution. Due to his mother's Jewish heritage, the daughter of the former Prussian Finance Minister Heinrich von Friedberg (who had converted in 1829), Mosler himself was exposed to attacks.

In addition to his duties at the bank, Mosler took on important positions early on, which involved representing the interests of the entire private banking sector. Since 1911, he achieved outstanding results at the head of the so-called "Stempelvereinigung," which he transformed from an initially not very significant association of Berlin banks and bankers into a powerful instrument of banking policy. He succeeded in bringing about a standardization of the banks' terms and conditions. Through these "General Agreements," adopted by the banking associations in 1913, the credit banks were united in common action based on essential principles of their business policy. At the same time, Mosler worked with the Berlin Chamber of Commerce, the Central Committee of the Reichsbank, and the Central Association of German Banking and Bankers. For many years, he was also chairman of the stock exchange board in Berlin and, in the 1930s, particularly opposed efforts to artificially organize stock exchange trading – especially by relocating all securities transactions to the stock exchange.

After his departure from the Management Board of Deutsche Bank at the beginning of 1939, Mosler was elected Chairman of the Supervisory Board shortly before his death. The Berliner Börsen-Zeitung wrote on the occasion of his death: "The man whose work extended far beyond the institution to which he had belonged for so long, and who dedicated such a large part of his work not only to the entire banking sector but to the German economy as a whole, did not like it when people wrote about him. It is characteristic of him that he was listed in the telephone book as a retired court assessor.

Show content of Mühlen, Alexander von zur

| Biographical data: | 1975 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board since 1 August 2020 |

Show content of Müller, Gustav

| Biographical data: | 16.11.1820 in Stettin - 08.07.1889 |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Administrative Board 1870-1889 (Co-Chairman 1888-1889) |

The Berlin banker Gustav Müller was part of the inner circle of founders who, from 1869 onwards, promoted the establishment of a bank intended to finance German foreign trade. This circle, among other things, conducted negotiations with the Prussian state and organized the group of initial subscribers to the shares of the new "Deutsche Bank". As a representative of his banking house G. Müller & Co., Müller acquired shares worth 162,000 Thalers for his bank and was elected to the first Administrative Board of Deutsche Bank.

In addition to his own banking house, he acted as a delegate for eleven other companies and private individuals, such as the banking houses Bamberger & Co. from Mainz, Koester & Co. from Mannheim, the Württembergische Hofbank from Stuttgart, and the Mitteldeutsche Creditbank from Meinigen. In total, the value of the acquired shares amounted to just over half a million Thalers. He remained a member of the Administrative Board until his death, taking over its deputy chairmanship after Eduard von Heydt's departure. Müller wielded great influence within this body and maintained close ties with the chairman, Adelbert Delbrück.

The banking house G. Müller & Co. in Berlin was a limited partnership of Mitteldeutsche Creditbank, whose founder was Rudolf Sulzbach, another member of Deutsche Bank's Administrative Board. Müller was a member of many administrative and supervisory boards, including the Supervisory Board of Disconto-Gesellschaft, and held stakes in the Austrian banking company, the Bergisch-Märkische Industrie-Gesellschaft, and, as a sub-participation of Deutsche Bank, in the Berliner Bankenverein.

In addition to his activities as a merchant and banker, Gustav Müller was involved in politics. Thanks to his international connections, he was appointed Belgian Consul and was a member of the Prussian House of Representatives (1858-1865) and the North German Confederation (from 1867).

Show content of Naphtali, Berthold

| Biographical data: | 20.04.1863 in Reichenbach/Silesia - 28.05.1911 in Berlin |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1911 |

Before Berthold Naphtali joined Deutsche Bank in 1904, he had already worked for 20 years at the Mendelssohn & Co. bank, where he was primarily involved in stock exchange business. Most recently, he was an authorized signatory at Mendelssohn. Shortly after joining Deutsche Bank, Naphtali became deputy director, in 1909 full director, and soon after deputy member of the Management Board. At the Supervisory Board meeting on December 21, 1910, Naphtali was appointed member of the Management Board of Deutsche Bank. Alongside Paul Mankiewitz, he played a significant role in expanding Deutsche Bank's stock exchange business. After his death, Oscar Wassermann succeeded him as stock exchange director.

Show content of Neske, Rainer

| Biographical data: | 1964 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2009-2015 |

Show content of Oesterlink, Hans

| Biographical data: | 14.05.1882 in Wroclaw - 25.12.1972 in Cologne |  |

| Institution: | Deutsche Bank | |

| Functions: | Chairman of the Supervisory Board Rheinisch-Westfälische Bank AG, Düsseldorf / Deutsche Bank AG West 1953-1957 |

Government Councillor Hans Oesterlink joined the Management Board of Deutsche Centralbodenkredit-AG in 1921, remaining a member until 1957. From 1957 to 1966, he was a member of the Supervisory Board of this important mortgage bank, from which he eventually retired due to age. Before the war, Oesterlink also held a central position in the German real estate finance system as Chairman of the Directorate of the Joint Group of German Mortgage Banks. From 1934 to 1941, he was a member of the Supervisory Board of Deutsche Bank, and from 1942 until the end of the war, Deputy Chairman of this body. Oesterlink retained this function even when the Allies prohibited Deutsche Bank, Berlin, from operating in 1945, and it was subsequently considered a "dormant" old bank. The ten independent constituent banks, which emerged in the three Western occupation zones in 1947/48, did not possess their own legal personality and were not successor institutions of the old bank. Hans Oesterlink chaired the first General Meeting of the old bank after the war, the so-called founding general meeting on September 25, 1952. At this meeting of the shareholders of the old Deutsche Bank, Berlin, the three successor institutions, Norddeutsche Bank AG, Hamburg, Rheinisch-Westfälische Bank AG, Düsseldorf, and Süddeutsche Bank AG, Munich, were founded. Concurrently, Oesterlink was elected Deputy Chairman of the Supervisory Board of Rheinisch-Westfälische Bank AG. He then finally served as Chairman of the Supervisory Board of this regional successor institution from 1953 to 1957.

Show content of Osterwind, Heinz

| Biographical data: | 28.05.1905 in Krefeld - 31.07.1988 in Frankfurt am Main |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1957-1971 |

Heinz Osterwind, son of an authorized signatory of Bergisch Märkische Bank, which merged into Deutsche Bank in 1914, began his professional career after graduating from high school in 1924 with an apprenticeship at the Deutsche Bank branch in his hometown of Krefeld. His subsequent stays abroad at the Deutsche Bank branch in Sofia and as an exchange officer at the Paris branch of the Equitable Trust Company of New York laid the foundation for his responsibilities in the industrial and foreign business of Deutsche Bank's Berlin headquarters, which he took on from 1930. In 1937, Osterwind became an authorized signatory, and two years later, he was appointed department director. In 1941, Osterwind was appointed to the management board of Kontinentale Öl AG, Romania's most important oil company, a majority shareholding of which had been acquired by Deutsche Bank. Furthermore, in Romania, he served as a board member delegated to the management of the industrial holding company Concordia.

After the end of the war, Osterwind initially resided in Laufenburg, Southern Baden. He could only be re-employed at Deutsche Bank after his denazification, which was carried out in Hamburg and classified him as "untainted." From 1947 to 1951, he was co-head of the Rheydt branch and subsequently one of the directors of the Munich branch. In 1953, he was appointed to the Management Board of Süddeutsche Bank, one of the three successor institutions of the old Deutsche Bank. After the re-merger to Deutsche Bank AG in 1957, he remained a member of the Management Board until his retirement in May 1971.

In addition to his domain, foreign business, he was responsible for the cash management of the entire bank. In domestic business, he was responsible for the branch districts of Frankfurt, Freiburg, and Mainz. As a founding member and long-standing Chairman of the Supervisory Board of AKA Ausfuhrkredit-Gesellschaft, he contributed significantly to the development of the long-term export financing system. After his departure from the Management Board of Deutsche Bank, he held the position of Deputy Chairman of its Supervisory Board until May 1978.

Show content of Philipp, Michael

| Biographical data: | 1953 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2000-2002 |

Show content of Plassmann, Clemens

| Biographical data: | 02.02.1894 in Warendorf - 26.04.1970 in Düsseldorf |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1940-1945 and 1957-1960 |

After elementary school, Plassmann attended the Gymnasium Paulinum in Münster from 1903 to 1912. Subsequently, he studied law and political science at the Universities of Freiburg/Br. and Münster. During the First World War, Plassmann was taken prisoner by the French, from which he was released to neutral Switzerland in 1917 due to illness, where he continued his studies. He returned to Germany in the summer of 1918. In the winter of 1918/19, he worked at the Prussian Ministry of War, for which he prepared a memorandum on the treatment of German prisoners of war in France. Afterwards, he completed a commercial apprenticeship at the C. Mittelviefhaus steam brickyard (maternal family) in Recklinghausen and prepared for his doctorate at the University of Würzburg (November 1920).

Early 1921, he joined the Dortmunder Bankverein, a branch of the Barmer Bank-Verein. In 1925, he became Head of the Secretariat. In 1927, he became Director of the Barmer Bank-Verein's Hamm branch. In 1930, he was transferred to the main branch in Düsseldorf. Early 1932, he was briefly Director at Bank-Verein Dortmund. During the merger of Barmer Bank-Verein with Commerz- und Privatbank, Plassmann was responsible for merging the Dortmund branches of both institutions. In May 1932, he was appointed to the headquarters of Commerz- und Privatbank in Berlin to handle various extensive credit commitments as a special task. From late 1932 to mid-1940, he was a member of the Management Board of Rudolf Karstadt AG. The successful reorganization of the financially troubled company and his experience in banking recommended him for a senior position in a major bank.

Through the mediation of banker Karl Kimmich, Plassmann joined the Management Board of Deutsche Bank in Berlin on July 1, 1940, where he remained until the end of the war. The appointment of Plassmann, a staunch Catholic, to the Management Board of Deutsche Bank was criticized by the National Socialists. At the end of the war, Plassmann was part of the so-called Hamburg Leadership Staff, as Deutsche Bank's Berlin headquarters were located in the Soviet sphere of influence. The British military government ordered Plassmann's dismissal in February 1946. After denazification in late 1947, he continued his work with the Hamburg Leadership Staff.

From mid-1948, he was crucially involved in the re-establishment and re-centralization of Deutsche Bank, which had been split into partial institutions. During this time, Plassmann was primarily responsible for maintaining a sense of community among the employees of the individual successor banks. From 1952, he was on the Management Board of Rheinisch-Westfälische Bank in Düsseldorf, and from 1957, on the Management Board of the reunited Deutsche Bank. In 1960, he moved to the Supervisory Board, serving as Deputy Chairman until his departure in 1967.

In 1954, the establishment of the David-Hansemann-Haus in Düsseldorf, an education and meeting center for aspiring German and foreign bankers, fell within the scope of the youth development he strongly promoted. He was a member of the Board of Trustees of the Donors' Association for the Promotion of Sciences and Humanities in Germany. Plassmann, shaped by both humanism and, enduringly, by Catholicism, was a rather unusual figure as a banker. His enthusiasm for classical Latin manifested itself in numerous chronograms and birthday verses, as well as in spoonerisms, which were repeatedly published under the anagram C. Palm-Nesselmanns.

Show content of Platenius, Wilhelm August

| Biographical data: | 26.01.1822 in Elberfeld - 03.03.1902 in Freiburg |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1870 |

Wilhelm August Platenius, originally from Elberfeld, emigrated to America very early, where he worked for various companies in Brooklyn. After returning to Germany in the mid-1860s, he became a member of the Supervisory Board of the newly founded Württembergische Vereinsbank in Stuttgart in January 1869. As its representative, Platenius acquired shares worth 141,000 Thalers during the founding of Deutsche Bank. He was a member for a short time of the first Board of Directors, which was elected by Deutsche Bank's first annual general meeting on March 21, 1870. Ludwig Bamberger recommended him to lead the newly founded bank, and to take up the position of Director, he resigned from the Board of Directors.

Although Platenius did not have formal banking training, he had acquired detailed knowledge of the discount business in the USA, and in Germany, he dealt with the trading of American securities.

Presumably, it was primarily the relationship of dependence on the Board of Directors that led Platenius to resign from the Management Board in February 1871, feeling disgruntled. Afterwards, Platenius retired to Freiburg and only appeared once more when a group of Bremen shareholders wanted to reduce Deutsche Bank's capital and prevent a takeover of Berliner Bankverein and Deutsche Union Bank. In various letters from Heidelberg, where Siemens was then taking his doctoral examination, Siemens implored Platenius to abandon his plan or at least remain neutral. Platenius did the latter, and the vote at the shareholders' meeting ended with a large majority for Georg Siemens and Hermann Wallich.

Show content of Price, Quintin

| Biographical data: | 1961 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2016 |

Show content of Rath, Adolph vom

| Biographical data: | 23.04.1832 in Würzburg - 17.06.1907 in Berlin |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Supervisory Board 1870-1889 / Chairman of the Supervisory Board 1889-1907 |

Show content of Rath, Jean Baptist

| Biographical data: | 10.04.1891 - 25.10.1965 |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board of the Rheinisch-Westfälische Bank 1952-1957, Deutsche Bank 1957-1958 |

Jean Baptist Rath was with Deutsche Bank for more than 38 years. On October 1, 1919, after an apprenticeship at the Mainz banking house Hochheimer & Meyer and several years of employment at the banking house Kronenberg & Co. in Mainz and Bad Kreuznach, he joined the Cologne branch, where he worked in the stock exchange and securities department. Already in mid-1921, due to his prudence and experience, he was entrusted with the management of the newly opened branch in Bad Godesberg, of which he was appointed director a year later. His business successes in Bad Godesberg, as well as his extensive professional knowledge and skills, were instrumental in his subsequent positions as director of the Düren branch (1925-1930) and the Münster branch (1930-1932). Ten years after his first appointment as branch director, Rath was called to the Cologne branch in 1932. In this responsible position, his clear and sound judgment and his expertise were of particular value. No fewer than 14 Rhenish stock corporations appointed him to their supervisory boards, 5 of them as chairman and 3 as deputy chairman. For almost 25 years, he was chairman of the Association of Banks and Bankers in Rhineland and Westphalia. With great energy, Rath drove the reconstruction of the completely destroyed Cologne branch, of which he had been appointed co-manager in 1943, alongside several other directors, as Senior Group Director of the entire bank. From spring 1948, he was a member of the management board of Rheinisch-Westfälische Bank, which had been spun off from Deutsche Bank, and in 1952, he joined the Management Board of the newly founded Rheinisch-Westfälische Bank AG. Following the re-merger of the three successor institutions in early 1957, he remained a member of the Management Board of Deutsche Bank AG until his retirement the following year.

Show content of Riley, Christiana

| Biographical data: | 1978 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2020 - 2023 |

Show content of Ritchie, Garth

| Biographical data: | 1968 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2016 - 2019 |

Show content of Ritchotte, Henry

| Biographical data: | 1963 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2012-2015 |

Show content of Rösler, Oswald

| Biographical data: | 26.05.1887 in Schweidnitz (Silesia) - 23.5.1961 in Brannenburg (Upper Bavaria) |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1933-1945 (Spokesman 1943-1945), Chairman of the Supervisory Board 1957-1960 |

Oswald Rösler came from humble beginnings. He was born the third of seven children. After the early death of his father, he had to help support the family. Rösler began his professional career as an accountant for a Breslau textile company, but in 1907 he switched to banking when he found employment with Barmer Bank-Verein Hinsberg, Fischer & Comp.

In July 1908, he joined the management of Disconto-Gesellschaft in Berlin as a correspondent, which was then the second-largest German commercial bank. His preferred area of work soon became foreign business. Rösler recognized the business necessity of developing a special reimbursement and letter of credit department, the establishment of which he pursued with great intensity. From 1921, he held a director position.

Upon the merger of Disconto-Gesellschaft with Deutsche Bank in October 1929, Rösler was appointed Deputy Member of the Management Board. After the displacement of Jewish board members from the bank, he was appointed a full member of the Management Board in 1933, along with Hans Rummel and Karl Ernst Sippell. From 1943 until the end of the war, Rösler served as spokesman for the Management Board of Deutsche Bank, although at that time the position of spokesman was more a formal designation than an actually prominent position within the Management Board.

His responsibilities also included the Böhmische Union-Bank (BUB), whose takeover by Deutsche Bank in 1938/39, together with other commitments, represents the company's expansion in the course of Nazi conquest policy. Rösler chaired the Supervisory Board of BUB until 1945. Nevertheless, he viewed both the political and economic objectives of Nazism with distrust. The denominational background, which Rösler shared with several board members (Abs, Bechtolf, Plassmann), earned Deutsche Bank the derogatory title "the Catholic bank," which it had to compensate for by admitting NSDAP members to the Management Board.

Through his friend, the Leipzig entrepreneur Walter Cramer (1886-1944), Rösler was privy to the assassination plans against Hitler in 1944. Arrested in September 1944, he was acquitted for lack of evidence after two months in custody in a trial before the Berlin People's Court on November 14, 1944, and released on the condition that he resign all his offices after the end of the war.

After the conquest of Berlin, Rösler was able to continue his work at the Deutsche Bank headquarters under Soviet supervision until June 1945. In mid-June 1945, however, he was arrested and, after several interim stops, interned by the Soviets in the former Buchenwald concentration camp until January 1950.

Immediately after his release, Rösler joined the management of Rheinisch-Westfälische Bank, one of the successor institutions of Deutsche Bank, which had been temporarily dismantled after World War II. Here he was particularly involved in rebuilding the foreign trade business. On his initiative, Ausfuhrkredit AG was founded in 1952 as a specialized institution for medium- and long-term export financing. Rösler took over the chairmanship of the Supervisory Board here, as well as at Deutsche Bank, which was re-established in 1957 (Honorary Chairman from 1960).

He also held other important supervisory board mandates at Mannesmann and Bayer. As early as 1951, he had been appointed to the board of the newly established professional organization for banks, the Association of German Banks.

Rösler possessed outstanding professional expertise in banking, a "clear conception of business realities and extensive knowledge of current business" (Georg Solmssen). He, like his fellow board members Hans Rummel and Fritz Wintermantel, was among those executives who rose from humble backgrounds to the top of a major German bank.

Show content of Rohr, Karl von

| Biographical data: | 1965 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1 November 2015 - 31 October 2023 |

Show content of Roland-Lücke, Ludwig

| Biographical data: | 21.02.1855 in Nieder Sikte - 13.02.1917 in Heidelberg |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1894-1907 |

The son of a papermaker attended the Progymnasium in Braunschweig and subsequently completed a banking apprenticeship. After his military service, he joined Deutsche Bank in Hamburg in 1876, where he initially focused primarily on the reimbursement business. In 1880, he was granted power of attorney, and in 1888, he became director of this important branch. In this capacity, he accompanied Georg Siemens on his second trip to America in 1893, which had become necessary due to the crisis at Northern Pacific Railroad Co. Deutsche Bank had participated in financing the expansion of the Northern Pacific Railroad Company by acquiring bond series and by taking part in the financing of subsidiaries. Upon returning to Germany, he authored a detailed information report on the situation of the Northern Pacific. His poor health prevented a return to New York, which Deutsche Bank had sought due to his relevant experience. In 1894, he accepted an offer from Siemens to become deputy director at the Berlin headquarters. Just half a year later, he was appointed to the Management Board of Deutsche Bank, to which he belonged until the end of 1907, with two illness-related interruptions (1900/01, 1903 to 1905). His experience in overseas business led to his simultaneous appointment as a member of the Management Board of Deutsche Ueberseeische Bank. Even during his time on the Management Board, Roland-Lücke continued to be involved in the railway business. Furthermore, he was represented on the Supervisory Boards of Schlesischer Bankverein and Privatbank zu Gotha, both of which later merged into Deutsche Bank. His special area of responsibility also included financial transactions with the company Siemens & Halske and its foreign subsidiaries. From 1912, he was a member of the Reichstag for the National Liberal Party.

Show content of Rummel, Hans

| Biographical data: | 09.03.1882 in Krautostheim - 20.08.1964 in Oberstdorf |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1933-1945 |

Hans Rummel was the eighth and youngest child of a Franconian farmer and brewer. After attending secondary school in Kitzingen, he completed an apprenticeship at his uncle Richard Kirchner's bank in Würzburg starting in 1898. In 1900, he joined Rheinische Creditbank in Mannheim as an employee. In early 1903, he moved to a private bank in Germersheim. He had to cut short a stay abroad to complete his training, during which he worked for some time at Credito Italiano in Genoa and Lausanne, in spring 1905 due to lack of funds. Between 1905 and 1918, he worked at Bayerische Staatsbank, first in Nuremberg and Aschaffenburg, and from 1909 in Augsburg. In August 1918, Rummel succeeded in finding a director's position at Bayerische Disconto- und Wechselbank in Kempten, after having unsuccessfully sought a position in private banking several times since 1916.

In 1921, he accepted an offer from Deutsche Bank and joined the management of the Augsburg branch, became head of the Munich branch in 1925, and finally moved to Deutsche Bank's headquarter in Berlin in 1927. In 1930, he was appointed deputy member of the Management Board, and in 1933, full member. His areas of responsibility included balance sheet and organization, and he was also responsible for the regions of Bavaria and Württemberg, which, among other things, led to him chairing the Supervisory Board of Daimler-Benz from 1942. He also held other important mandates as Spokesman of the Supervisory Board for MAN, WMF, Krauss-Maffei, and the Hutschenreuther porcelain factory.

In 1945, Rummel was arrested by the American military government in Nuremberg as part of a general wave of arrests targeting leading business figures and was interned in various locations until April 1947. After his release, he declined to rejoin Deutsche Bank as a member of the Management Board. However, from 1952 to 1957, he remained connected to the company as Deputy Chairman of the Supervisory Board of Süddeutsche Bank, one of the three successor institutions of the temporarily dismantled Deutsche Bank.

On April 30, 1957, which marked the completion and culmination of his 75 years of banking activity, he chaired the General Meeting of Süddeutsche Bank, where the merger with Deutsche Bank West and Norddeutsche Bank was approved, the relocation of the registered office to Frankfurt am Main was decided, and the company name was changed to: Deutsche Bank Aktiengesellschaft.

Rummel's outstanding significance lies in the field of operational profitability. Already since the 1920s, he had intensively dealt with questions of profitability and productivity in banking operations, especially against the backdrop of the temporarily enormously inflated personnel levels in the credit system.

His specialized knowledge in this area led to him being entrusted in 1929 with the technical execution of the merger of Deutsche Bank with Disconto-Gesellschaft. In preparation for what was then the largest merger in German banking, Rummel conducted a review of the entire apparatus of the bank and its branches and summarized the results of his work in a memorandum, which became an essential basis for the decision taken in autumn 1929 to merge the two institutions. In numerous studies, which earned him the reputation as the "cost conscience of the German credit industry," he attempted to place banking management theory on a new foundation, e.g., by calculating interest margins for profitability assessment and by proposing a tripartite division of banking business into the segments of credit, payment transactions, and securities trading.

In the Banking Inquiry Commission of 1933/34, which was conducted to prepare for a new legal regulation of the banking system, Rummel played a decisive role. There, he presented two written reports to the inquiry committee that made his name known beyond Germany's borders: "The Question of Bank Profitability, Their Costs and Calculation" and "Attempts to Improve Profitability, Reduce Costs, and Increase Revenue.

Show content of Russell, Emil

| Biographical data: | 27.07.1835 in Clemenswerth - 23.10.1907 in Berlin |  |

| Institution: | Disconto-Gesellschaft | |

| Functions: | Joint Proprietor 1876-1900 |

The family name Russel (also often spelled Russell in the 19th century) is of English origin. Emil Russell's great-grandfather had come to the Emsland region as a war commissioner for English troops during the Seven Years' War. His descendants were merchants and administrative lawyers. Emil Russell also began studying law, which he completed in the summer of 1860 with the examination to become a government assessor. While he was still taking his exams, he was elected mayor of Papenburg, which had just been granted city status. In the elections for the North German Reichstag in 1867, he failed in his candidacy as a National Liberal applicant. At the instigation of Johannes Miquel, Russell's colleague in the Provincial Parliament in Hanover from 1867-1869, the Disconto-Gesellschaft in Berlin offered him the position of Syndikus (legal counsel). In the spring of 1872, he took up this position at what was then Germany's leading bank. The family's center of life thus shifted from the Emsland region to Berlin. His first task was to secure German capital invested in Romanian railway construction projects, which was threatened with total loss after the collapse of Bethel Henry Strousberg's railway empire. Together with the banking house S. Bleichröder, the Disconto-Gesellschaft founded a rescue company, on whose supervisory board Russell played a significant role in the restructuring. In 1874, Russell received power of attorney and in 1876 he was admitted to the circle of personally liable partners of the Disconto-Gesellschaft. In the bank's executive committee, his main tasks included the legal establishment of participations, as well as the co-management and supervision of companies in which the Disconto-Gesellschaft had an interest. Together with Max von Schinckel of Norddeutsche Bank in Hamburg, Russell founded the Brasilianische Bank für Deutschland in 1887. The merger of Norddeutsche Bank with Disconto-Gesellschaft in 1895 was also the joint work of these two men. In 1900, Russell resigned from his position as a partner to join the Supervisory Board of the Disconto-Gesellschaft, where he served until September 1905. Russell was considered a particular authority in the field of monetary affairs. In 1883, he became a member of the commission for advising on the stock corporation law amendment and in 1891, of the commission for advising on the Civil Code.

Show content of Russell, Enno Ernst

| Biographical data: | 25.05.1869 in Papenburg - 23.09.1949 in Hohenborn near Kassel |  |

| Institution: | Disconto-Gesellschaft | |

| Functions: | Joint Proprietor 1902-1929 |

After attending the Kaiser Wilhelm-Gymnasium in Berlin and passing his Abitur, Russell completed his military service as a one-year volunteer in Strasbourg. He began his law studies in the winter semester of 1888/89 in Leipzig and continued them in Berlin, where he completed them with a doctorate.

He learned the banking business at Norddeutsche Bank in Hamburg, at Wm. Brandt & Sons in London, and in Paris. In January 1893, he embarked on a nearly two-year world tour, which served to complete his education and took him, among other places, to the World's Columbian Exposition in Chicago, as well as to the Disconto-Gesellschaft's important foreign commitments in South America, New Guinea, and East Asia. His detailed travel diary "Reise um die Welt" has been available in book form since 1995.

After his return, Russell joined the Disconto-Gesellschaft on January 1, 1895, received power of attorney in 1899, became deputy director, and finally, in 1902, one of the then six managing partners. His main task was the management and supervision of the bank's increasingly expanding branch network. Within this framework, Russell was also responsible for human resources. As a member of the Supervisory Board, he represented the interests of the Disconto-Gesellschaft, among others, at the Preußische Boden-Credit-Aktien-Gesellschaft in Berlin, the Deutsche Hypothekenbank in Meiningen, and the Sächsische Maschinenfabrik vorm. Richard Hartmann AG in Chemnitz.

Upon the merger of Disconto-Gesellschaft with Deutsche Bank in October 1929, Russell resigned from the management board and was elected Deputy Chairman of the Supervisory Board. He retained this position until 1941. He spent his last years at Gut Hohenborn in the Zierenberg district near Kassel.